- TOP

- Corporate Governance

Corporate Governance

Basic Concept

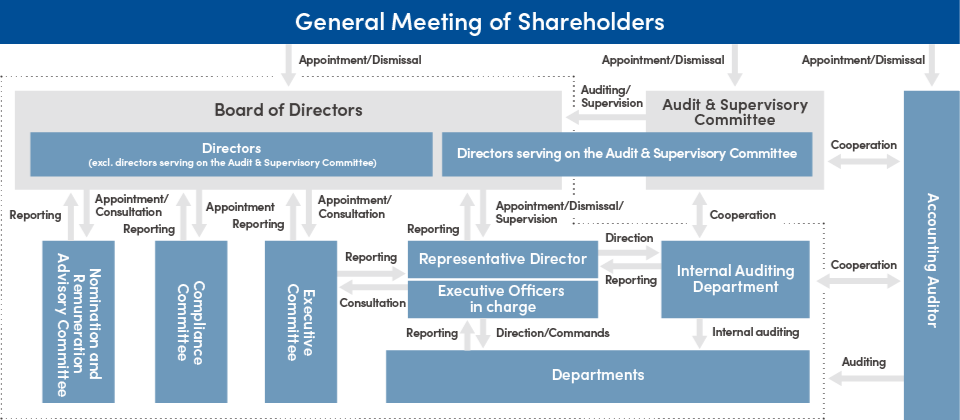

We recognize the importance of sustainably maximizing corporate value and contributing to society, and of gaining all stakeholders’ continued trust. Accordingly, we have adopted the system of an Audit & Supervisory Committee to improve our corporate governance and enhance our management’s soundness and transparency by strengthening the directors’ supervisory functions. Through the Committee, we will secure transparency in management decision-making and supervision of business execution. We will also establish an internal control system and we ensure its thorough operation while striving to maintain and strengthen corporate governance.

Corporate Governance System

Board of Directors

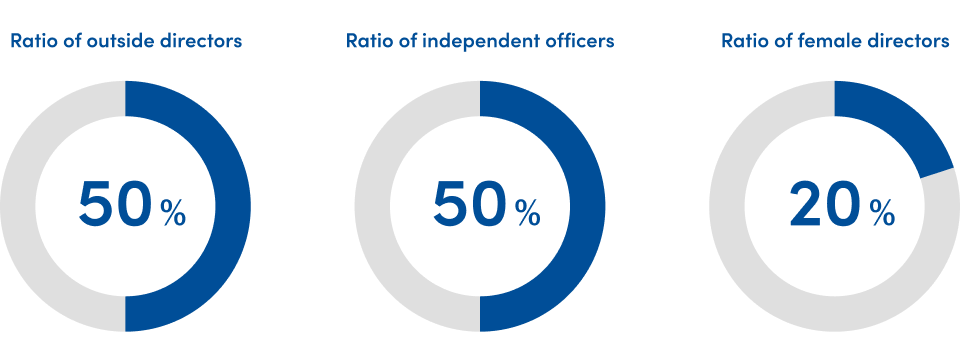

We stipulate in the Articles of Incorporation that the number of Directors (excluding those who are Audit & Supervisory Committee Members) shall not exceed 8 and that the number of Directors who are Audit & Supervisory Committee Members shall not exceed 5. Currently, we have appointed 9 Directors (male: 7, female: 2). We appoint members who constitute the Board of Directors, taking into account the balance between experience, knowledge and skills and diversity, including gender, internationality, such as international work experience, work experience and age. Recognizing the importance of gender diversity, we have set the target for the ratio of female Directors at 30% or more by the fiscal year ending May 31, 2030. At least one-third of the members appointed to the Board of Directors shall be independent Outside directors, and at least one member shall have a considerable amount of knowledge related to finance and accounting as a Director who is an Audit & Supervisory Committee Member.

The skill matrix of candidates for Directors and the reasons for nomination of each candidate are included in the Notice of the Annual General Meeting of Shareholders, in order to disclose the skill composition of the management team that we should have. In addition, Independent Outside Directors include those who themselves have corporate experience and those who concurrently serve as directors of other companies. Thus, we have established a system in which we can expect to receive opinions that are not based on those of ourselves.

Audit & Supervisory Committee

The Audit & Supervisory Committee comprises four directors. All Committee members are outside directors and independent directors. Director members of the Committee provide oversight from their independent perspectives on corporate management, bringing expertise in areas such as legal affairs and accounting, as well as executive experience at other companies. Director members of Committee express opinions on directors’ performance of duties, at meetings of the Board of Directors and other meetings. To monitor governance and its operational status and to audit and supervise directors’ daily activities, including their performance of duties and day-to-day activities, holding monthly Committee meetings for this purpose. The Committee also convenes meetings with the Internal Auditing Department and accounting auditors, sharing pertinent information for auditing.

Efforts to Enhance Corporate Governance

We have taken a range of measures for enhancing corporate governance to achieve management soundness and transparency. In 2015, we adopted an Audit & Supervisory Committee system with four outside directors. In 2019–2021, we have strived to ensure independence by selecting and increasing the number of independent directors. In 2021, we added a female director (bringing the number to two) to increase the Board’s diversity. Decisions about remuneration for directors (excluding those who are Audit & Supervisory Committee Members) will now be decided by a resolution of the Board of Directors instead of the Representative Director. The skills matrix of each director will also be disclosed. In 2023, we increased the number of independent directors, and established the Nomination and Compensation Advisory Committee as a voluntary advisory body to the Board of Directors for the purpose of enhancing the independence and objectivity of the functions of the Board of Directors with regard to the nomination and remuneration of directors, as well as to strengthen accountability.

Major Initiatives

Evaluation of Effectiveness of Board of Directors

To assess the business management, etc., of the Board of Directors, as delegated by the shareholders, we conducted an effectiveness evaluation of the Board every year. Based on the results, the Board implements its own PDCA cycle to enhance corporate management.

For the Effectiveness Evaluation of the Board of Directors in the fiscal year ended May 31, 2023, we conducted a questionnaire survey on the effectiveness of the Board or Directors, etc. targeting all Directors. The survey results were brought to the Audit & Supervisory Committee for discussion, and based on the opinions obtained, the Board discussed the survey results, shared common perceptions, and decided on the policy for improvements. The survey results for the said fiscal year indicated that, for the major items of the questionnaire—namely, “Responsibilities of the Board,” “Board size and composition,” “Frequency of Board meetings,” “Decision-making process of the Board,” and “Quality of information provided to the Board”—there were many opinions that evaluated these items as Appropriate or Generally Appropriate. Therefore, we determined that the effectiveness of the Board was ensured in the said fiscal year.

Going forward, as our business scale and social responsibilities as a listed company continue to expand, we will continuously carry out initiatives to enhance the effectiveness of the Board of Directors, such as by fostering multifaceted perspectives that incorporate the knowledge of Outside Directors by establishing opportunities for discussion regarding medium- to long-term management issues and business direction as a part of Directors’ training, further strengthening the management foundation, and enhancing information provision that deepens Outside Directors’ understanding of business activities and the direction of business as well as document and information provision that contributes to deliberations by the Board of Directors.

Policies and Procedures in Determining Remuneration for Directors

We make decisions at meetings of the Board of Directors regarding the policy for deciding the details of remuneration, etc. of Directors (excluding those who are Audit & Supervisory Committee Members) based on the details of reports from the Nomination and Remuneration Advisory Committee following consultations with the said Committee.

At the Board of Directors meeting held in July 2023, we resolved to partially revise the policy for deciding the details of remuneration, etc. of Directors (excluding those who are Audit & Supervisory Committee Members) for the fiscal year ending May 31, 2024 onward, to provide performance-linked bonuses as short-term incentive remuneration and to grant stock remuneration-type stock options as non-monetary individual remuneration to Directors (excluding those who are Audit & Supervisory Committee Members) subject to approval by the General Meeting of Shareholders.

Policy for Determining the Amount or Calculation Method of Individual Remuneration, etc. of Directors Regarding Basic Remuneration (fixed monetary remuneration) and Performance-Linked Remuneration

As individual monetary remuneration, etc. of Directors (excluding those who are Audit & Supervisory Committee Members), we shall pay basic remuneration (fixed monetary remuneration) and performance-linked bonuses as short-term incentive remuneration for improving business performance in each fiscal year.

The amount of individual basic remuneration for Directors (excluding those who are Audit & Supervisory Committee Members) shall be updated and determined each fiscal year within the limits of the total amount of remuneration resolved at the General Meeting of Shareholders, taking into consideration the responsibilities and business execution status of each Director and the Company’s performance and economic conditions.

The amount of individual performance-linked bonuses for Directors (excluding those who are Audit & Supervisory Committee Members) shall be calculated within the range of 0% to 200% based on the degree of achievement against the performance targets for each fiscal year within the limit of the total amount of remuneration resolved at the General Meeting of Shareholders, and shall be updated and determined each fiscal year, taking into consideration each Director’s position and responsibilities. The performance target for each fiscal year shall be based on consolidated net sales, which is the most important management indicator of the Company.

The amount of individual basic remuneration for Directors who are Audit & Supervisory Committee Members shall be determined by consultation of all Audit & Supervisory Committee Members within the limits of the total amount of remuneration resolved at the General Meeting of Shareholders.

Introduction and Decision Policy for Non-Monetary Remuneration

With regard to individual remuneration, etc. of Directors (excluding those who are Audit & Supervisory Committee Members), stock options with share price conditions and stock remuneration-type stock options may be granted as medium- to long-term incentive remuneration. The ratio of these stock options to basic remuneration shall be decided and appropriate limits and conditions shall be set based on the business environment, remuneration level at other companies, etc. in order to make the stock options incentives that encourage the maximization of Directors’ performance and willingness to contribute in addition to appropriate risk taking as a result of the further strengthening of the link with shareholder value. The introduction of a non-monetary remuneration plan as other individual remuneration, etc. of Directors shall require a resolution of the Board of Directors. When introducing such a remuneration plan, the Board of Directors shall decide the details of the plan, the policy for determining the amount (calculation method), and the ratio of each form of remuneration that constitutes the individual remuneration, etc. based on the details of a report from the Nomination and Remuneration Advisory Committee following consultations with the said Committee.

Policy for Determining the Timing and Conditions of Payment and Grant of Remuneration, etc. to Directors

Among the remuneration, etc. for Directors, fixed remuneration shall be paid monthly, and the performance-linked bonus to be introduced as individual remuneration, etc. of Directors (excluding those who are Audit & Supervisory Committee Members) shall be paid in a lump sum at a certain time each year. In addition, stock options with share price conditions and stock remuneration-type stock options shall take into consideration the timing of payment/granting, conditions, etc. based on stock options granted in the past, number of years in office, etc.

This shall not apply in cases where expenses to be paid as remuneration are separately incurred.

Matters Concerning the Decisions on Remuneration, etc.

Individual remuneration, etc. of Directors (excluding those who are Audit & Supervisory Committee Members) shall be decided at a meeting of the Board of Directors based on the details of a report from the Nomination and Remuneration Advisory Committee following consultations with the said Committee.

In the event of issuing stock options with share price conditions and stock remuneration-type stock options for Directors (excluding those who are Audit & Supervisory Committee Members), a resolution of the General Meeting of Shareholders shall be obtained, and details of the proposal for the General Meeting of Shareholders shall be decided by the Board of Directors based on the report of the Nomination and Remuneration Advisory Committee after consultation with the Committee.

Policies and Procedures in Nominating Candidates for Directors and Dismissing Directors

The Articles of Incorporation stipulate that the number of directors (excluding those who are Audit & Supervisory Committee Members) shall not exceed eight and that the number of Audit & Supervisory Committee Member directors shall not exceed five.

Appointment of members of the Board of Directors considers the balance between experience, knowledge and skills, and diversity. We nominate candidates for directorships (excluding those who are Audit & Supervisory Committee Members) based on our policy, seeking people with extensive knowledge and experience in the relevant business, who should make significant contributions through the relevant business, should fulfill their duties as directors, and should contribute to improving our corporate value. In nominating Directors as Audit & Supervisory Committee member candidates, we select individuals who can provide opinions on overall management by utilizing their abundant, practical experience and knowledge of corporate management. This means we try to nominate candidates who have experience as executives at other companies or are legal experts familiar with corporate legal affairs, accounting, and compliance.

The procedure for nominating candidates for Directors shall be decided by the Board of Directors based on the details of a report from the Nomination and Remuneration Advisory Committee following consultations with the said Committee regarding candidates proposed by the Representative Director & CEO as persons who meet the requirements of the above-mentioned policy.

The Board of Directors monitors and supervises the status of business execution by each director. If they determine that any director is disqualified, they will discuss whether or not to dismiss such a director based on the details of a report from the Nomination and Remuneration Advisory Committee following prior consultations with the said Committee.

Training Policy for Directors

We strive to ensure that Board deliberations are thorough by providing Board documents, explanations, and relevant information in advance for the directors to fulfil their auditing and supervisory functions. A dedicated secretariat has been assigned to support the smooth performance of duties for the Audit & Supervisory Committee, comprising outside directors. The secretariat’s participation in major meetings and access to key documents enable the provision of reports and other information to the Committee in a timely manner as required. It also provides opportunities for third-party training of outside directors, for which the company covers the expenses.

Strengthening of Group Governance

We have established the Rules on Management of Subsidiaries as the basic policy for involvement in the management of our subsidiaries, and we have strived to develop a system leading to stronger Group governance. This includes efforts such as concluding business management agreements with subsidiaries pursuant to these Rules. The Internal Auditing Department implements regular audits to verify whether our subsidiaries’ business operations comply with laws, the Articles of Incorporation, internal rules, and other regulations.

Directors

Directors (1.74MB)

Chika Terada Representative Director & CEO, CPO

Chika began his career with MITSUI & CO., LTD. During that time, he relocated to Silicon Valley to help local venture firms develop their Japan-focused efforts. In 2007, he founded Sansan, Inc., providing digital transformation (DX) services that change how people work, including the namesake Sansan sales DX solution. In 2021, Sansan, Inc. was listed on the First Section of the Tokyo Stock Exchange (now TSE Prime Market Index).

Kei Tomioka Director, Executive Officer, COO

Kei began his career with Oracle Corporation Japan, and was based in Shanghai and Bangkok, taking charge of market development across Greater China (China, Hong Kong, Taiwan), Southeast Asia, and India. In 2007, Kei co-founded Sansan, Inc. and has led business efforts for Sansan, the sales DX solution. As COO, he oversees Sansan and other B2B SaaS businesses. From 2023, he has served as CEO of Sansan Global Pte. Ltd.

Kenji Shiomi Director, Executive Officer, CISO, DPO, Engineering Division Head

Kenji co-founded Sansan, Inc. in 2007, after working with Bussan System Integration Co., Ltd. (now Mitsui Knowledge Industry Co., Ltd.), where he designed and developed mail systems for major mobile carriers. Since 2012, he has been in charge of the Eight B2C business card management app. Now as Engineering Division Head, he oversees the company-wide technology strategy and strengthens its engineering group. In 2023, he also assumed the role of President of Sansan Global Development Center, Inc.

Yuta Ohma Director, Executive Officer, CHRO

Yuta began his career at a human resources company, where he helped launch a consulting service. He then went independent and served as a director for a venture firm in recruitment. Yuta joined Sansan, Inc. in 2010 as a Manager in sales and later became the head of HR. As Chief Human Resources Officer (CHRO), he leads strategies for optimizing the value and productivity of Sansan’s workforce.

Muneyuki Hashimoto Director, Executive Officer, CFO

Muneyuki worked for foreign securities companies in Tokyo and New York for nearly 9 years, providing M&A and financing advisory services. He then moved to a group company of the Development Bank of Japan to work in private equity. He joined Sansan, Inc. in 2017, and was appointed CFO in 2018 to lead the company’s financial strategy.

Maki Suzuki Outside Director, Audit & Supervisory Committee Member

Maki, an attorney at law, was admitted to the New York State Bar Association after working since 2003 at TMI Associates. She joined the Shintaro Sato Law Office in 2017 and has been a member of the Dai-Ni Tokyo Bar Association since 2021. She became an Outside Director of Sansan, Inc. in August 2022. Her expertise is in corporate legal affairs and compliance, and she provides recommendations from a legal and diversity perspective.

Toru Akaura Outside Director, Audit & Supervisory Committee Member

Toru is a General Partner at Incubate Fund. Following his involvement in investment development tasks at Japan Associated Finance Co., Ltd. (now JAFCO Group Co., Ltd.), he founded his own venture capital company. Having become an Outside Director of Sansan, Inc. in August 2007, he makes general management recommendations.

Toko Shiotsuki Outside Director, Audit & Supervisory Committee Member

Toko is a Director at CyberAgent, Inc., a Junior Accountant, and a Juris Doctor. After working with Japan Airlines Co. Ltd., she joined CyberAgent as a Standing Auditor, and in 2017 became a Director. Toko became an Outside Director of Sansan, Inc. in August 2021. She gives guidance on auditing and diversity, applying accounting and legal knowledge along with corporate experience.

Taro Saito Outside Director, Audit & Supervisory Committee Member

After working with DENTSU Inc., Taro founded dof inc. in 2009 and became its CEO. He is also working as a Communication Designer. Taro became an Outside Director of Sansan, Inc. in August 2022. He provides recommendations on general management issues based on his extensive experience as a communication designer and the insights he has acquired as a board member of several companies.