Corporate Governance

Basic Concept

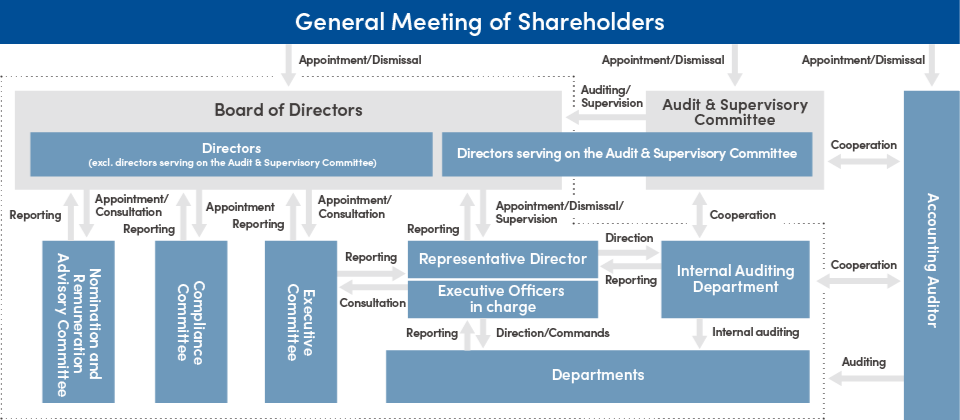

We recognize the importance of sustainably maximizing corporate value and contributing to society, and of gaining all stakeholders’ continued trust. Accordingly, we have adopted the system of an Audit & Supervisory Committee to improve our corporate governance and enhance our management’s soundness and transparency by strengthening the directors’ supervisory functions. Through the Committee, we will secure transparency in management decision-making and supervision of business execution. We will also establish an internal control system and we ensure its thorough operation while striving to maintain and strengthen corporate governance.Corporate Governance Efforts

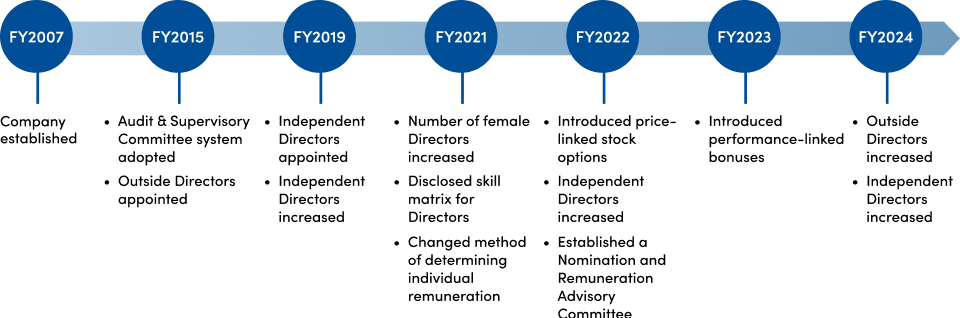

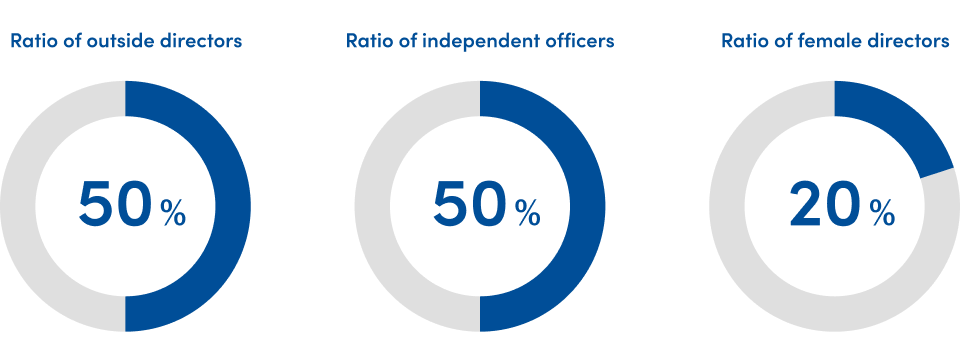

After our establishment, we adopted the organizational form of a Company with an Audit & Supervisory Committee and appointed four outside directors in FY2015. In FY2019, we selected and increased the independent directors, and sought to ensure and increase their independence. In FY2021, we also aimed to diversify the composition of the Board of Directors by appointing two female directors, and we disclosed the skill matrix of the directors. We also changed the method of determining directors’ individual remuneration (excluding Audit & Supervisory Committee members) from the Representative Director’s sole decision to a Board of Directors resolution. In FY2022, we introduced price-linked stock options to share value with the shareholders and increase medium-to-long-term incentives for the directors. Additionally, we increased the independent directors to four and established the Nomination and Remuneration Advisory Committee, an optional advisory body, to strengthen the independence, objectivity, and accountability of the Board’s functions related to nomination and remuneration. In FY2023, we introduced annual performance-linked bonuses for directors (excluding Audit & Supervisory Committee members) as a short-term incentive for business performance improvements. From FY2024, we increased the outside directors and independent directors to five to further strengthen decision-making and oversight by the Board and ensure its independence.Progress in Strengthening Corporate Governance

Enhancing Corporate Governance

We are a Company with an Audit & Supervisory Committee, and we have established the Nomination and Remuneration Advisory Committee as an optional committee and the Management Meeting as an advisory body on business execution. We have adopted our current governance structure*1 with the belief it can facilitate stronger Board decision-making and oversight, as well as swift business execution, enabling transparent, fair, and fast management decision-making.

- *1 As of August 31, 2025 (FY2026)

Board of Directors

Our Board of Directors comprises seven directors (excluding Audit & Supervisory Committee members) (including two outside directors) and three directors serving on the Audit & Supervisory Committee (all three are outside directors), for a total of 10 (five full-time, five outside) directors. The Board members are appointed for balance of experience, insight, competencies, and diversity, including gender, international perspective, career, and age. We aim for at least 30% female directors by FY2029 in view of the importance of gender, and to combine this with an appropriate scale of the Board considering factors such as our management policies and business. We also appoint at least one-third of directors as independent outside directors, and at least one director serving on the Audit & Supervisory Committee who has substantial finance and accounting knowledge. The term of office for directors (excluding Audit & Supervisory Committee members) is set at one year to enable swift and appropriate responses to rapid changes in the business environment and to ensure clear accountability for management. The term of office for directors serving on the Audit & Supervisory Committee is two years, as stipulated by the Companies Act.Composition of the Board of Directors

Board Activities

To ensure efficient and fast decision-making by the Board of Directors, the Ordinary Board of Directors meeting is held, in principle, once a month, and Extraordinary Board of Directors meetings are held as needed. In accordance with laws and regulations and our Articles of Incorporation, the Board deliberates and decides on management plans and other important matters and receives reports from the executive directors to conduct supervision of the status of business execution. In FY2024, we held 13 Board meetings with 99.2% director attendance. The Board deliberated on a wide range of themes, including management plans, business strategies and other matters concerning sustainability, matters concerning compliance and governance, and matters concerning the organization and personnel strategy. From FY2023, to revitalize the Board and train the directors, we established a forum for free discussion after concluding a Board meeting, with lively discussions on a variety of measures that help improve our medium-to-long-term corporate value, and simulations, etc. based on those measures. Note that the Medium-Term Financial Policy disclosed in July 2024 was formulated after these discussions.Evaluation of the Effectiveness of the Board of Directors

We annually evaluate the effectiveness of the Board of Directors’ business management and other functions, as delegated by shareholders, in an effort to evaluate the extent to which the Board is fulfilling the roles expected of it. The Board incorporates the results in its own plan-do-check-act (PDCA) cycle to bolster corporate governance. For the evaluation of effectiveness in FY2024, we conducted a questionnaire survey targeting all directors. The survey results were brought to the Audit & Supervisory Committee for discussion, and based on the opinions obtained, the Board deliberated on the survey results, shared common perceptions, and decided on the policy for improvements. The survey results indicated that, for the major items of the questionnaire—namely, “Role and responsibilities of the Board,” “Composition and diversity of the Board,” “Quality of management and discussions of the Board,” “Decision-making process of the Board,” and “Quality of information provided to the Board,”there were many opinions that evaluated these items as appropriate or generally appropriate. Therefore, we determined that the effectiveness of the Board was ensured in the said fiscal year. The free discussion conducted after the Board of Directors meetings for the purpose of revitalizing the Board of Directors and training directors, which started in the previous fiscal year, continues, establishing active exchange of opinions based on the diverse perspectives, knowledge, and experience of each director. In response, we will make further improvements in the theme setting and operation aspects, improve the knowledge of each director, and lead to strengthening the decision-making function and supervisory function of the Board of Directors, aiming to further improve the effectiveness of the Board of Directors.

Audit & Supervisory Committee

The Audit & Supervisory Committee comprises three directors, all of whom are outside directors. The directors serving on the Committee include attorneys, people with insight on finance and accounting, and people experienced in corporate management. Each brings their own professional ethics perspective to management oversight. They give their opinions on directors’ performance of duties at Board of Directors and other meetings.Audit & Supervisory Committee Activities

The Audit & Supervisory Committee meets monthly to monitor governance and its operational status, and to audit and supervise directors’ daily activities, including performance of duties, and conducts audits based on auditing plans. it also meets with the Internal Auditing Department and accounting auditors, sharing information for auditing. In FY2024, we held 13 Committee meetings, with 97.6% attendance. The Committee deliberated, reported, and debated on topics including audit policies, audit plans, audits of the status of directors’ performance of duties, internal control system audits, the results of the effectiveness evaluation of the Board of Directors, and the operational status of compliance and the whistleblowing system. The Board of Directors received reports on our initiatives addressing key sustainability issues (materiality). In addition, the Audit & Supervisory Committee confirmed progress by conducting hearings with the relevant departments. It also exchanged views of important auditing issues to ensure sufficient communication between the Committee members and the Representative Director and deepen mutual understanding.Nomination and Remuneration Advisory Committee

To strengthen the Board of Directors’ function regarding directors’ nomination and remuneration, as well as accountability regarding independence and objectivity, we have established the Nomination and Remuneration Advisory Committee as an optional committee with the appropriate involvement of independent outside directors. The Committee comprises three or more members appointed by Board resolution, with independent outside directors as a majority to ensure independence. The chair is selected from the independent outside director members by Committee resolution. The Committee deliberates in advance and provides recommendations to the Board on nomination, appointment and dismissal, and remuneration of directors (excluding Audit & Supervisory Committee members) and other matters on which the Board is consulted, and the Board makes decisions based on the recommendations. Since the 17th shareholder meeting in August 2024, the Committee comprised three independent outside directors and one full-time director. From the 18th shareholder meeting in August 2025, the Committee has comprised three independent outside directors to strengthen its independence.Nomination and Remuneration Advisory Committee Activities

In FY2024, we held three Nomination and Remuneration Advisory Committee meetings, with 93.8% attendance. The Committee deliberated on matters concerning the selection of director candidates in the 17th shareholder meeting, matters concerning the policy for determining the remuneration of directors (excluding Audit & Supervisory Committee members), the determination procedures and individual remuneration, and matters concerning remuneration proposals for the directors (excluding Audit & Supervisory Committee members) in the 16th shareholder meeting, and the remuneration levels to be applied from the 18th shareholder meeting onward.Executive Committee

We established the Executive Committee as an advisory body for business execution, and developed a structure that contributes to appropriate and fast business execution by the Board of Directors, responsible officers, etc. The Committee comprises all full-time directors and responsible officers and is held as needed. It is operated with an awareness of the agility and flexibility of business execution and decision-making. For example, depending on advisory matters, non-members may be invited to attend.Policy and Process of Determining Director Remuneration

The policies for determining the remuneration of directors (excluding Audit & Supervisory Committee members) are determined in the Board of Directors based on the Nomination and Remuneration Advisory Committee’s recommendations. The remuneration of directors not serving on the Audit & Supervisory Committee (excluding outside directors) comprises the basic remuneration as fixed monetary remuneration, performance-linked bonuses as short-term incentive compensation, and price-linked stock options and stock compensation-type stock options as medium-to-long-term incentive compensation. Note that, considering their roles and duties, the remuneration of the outside directors not serving on the Committee and the directors serving on the Committee shall be only the basic remuneration, which is fixed monetary remuneration.Policy for Determination of the Amount of Individual Remuneration and Calculation Methods for Basic Remuneration (Fixed Monetary Remuneration) and Performance-Linked Compensation for Directors

Individual monetary remuneration for directors not serving on the Audit & Supervisory Committee (excluding outside directors) comprises basic (fixed monetary) remuneration and annual performance-linked bonuses as short-term incentives for business performance improvements. Only basic (fixed monetary) remuneration is paid to outside directors not serving on the Committee. The individual basic remuneration of directors not serving on the Committee is updated and determined annually within the limit resolved at the General Meeting of Shareholders based on responsibilities, performance, our business performance, the economy, etc. The individual performance-linked bonuses of directors not serving on the Committee (excluding outside directors) are updated and determined annually, based on progress against annual performance targets, set each year within the limit resolved at the General Meeting of Shareholders considering directors’ responsibilities and other factors. For each fiscal year, an individual base bonus amount is set as the basis for calculation, along with a payment coefficient in accordance with progress against performance targets. The amount calculated by multiplying the base bonus amount by the payment coefficient in the range of 0–200% is paid. We use consolidated sales growth rate and adjusted operating profit*2, which are important management indicators, for the performance targets for each fiscal year. The ratio of total performance-linked bonuses to total monetary remuneration is designed to represent approximately 30%. Individual basic remuneration for directors serving on the Audit & Supervisory Committee is deliberated by all Committee members and set within the limit resolved at the General Meeting of Shareholders.

*2 Operating profit + share-based payment expenses + expenses arising from business combinations (amortization of goodwill and amortization of intangible assets)

Introduction of and Policy for Determining Non-Monetary Remuneration

Individual remuneration of directors not serving on the Audit & Supervisory Committee (excluding outside directors) may include price-linked and stock compensation-type stock options as medium-to long-term incentives. Their ratio to basic remuneration, appropriate limits, and conditions are set based on business environment and other companies’ remuneration levels, etc., to maximize directors’ performance and motivation, strengthen correlation with the stock price, and encourage appropriate risk-taking. The stock options to be granted from FY2025 onward shall set forth a malus clause based on the policy for determining remuneration, etc. of Directors. This clause enables all or part of unexercised stock options granted to a director to be forfeited in specific cases by determination of the Board of Directors following consultation with the Nomination and Remuneration Advisory Committee. Such specific cases include a serious violation against laws and regulations or internal rules of the Company caused by the relevant director or in an area in charge of said director. A Board of Directors resolution is required for introducing other non-monetary remuneration. The Board also decides, based on the Nomination and Remuneration Advisory Committee’s recommendations, how such remuneration and its amount (formula) are determined, and the proportion of each type for each individual.Policy for Determining the Timing and Conditions of the Level/Payment/Distribution of Director Remuneration

Directors’ remuneration is designed by using the officers’ remuneration database of an external research organization to reference the remuneration levels of companies of a similar business scale as ours and belonging to related industries under similar business conditions. Directors’ fixed remuneration is paid monthly. Performance-linked bonuses are paid at a fixed time in an annual lump sum. The timing of providing/distributing price-linked and compensation-type stock options, and their conditions, etc. are set based on factors such as past distributions and years of service. This does not preclude other compensation that may arise separately.Matters Related to Determining Remuneration Content

The Board determines individual remuneration for directors not serving on the Audit & Supervisory Committee based on the Nomination and Remuneration Advisory Committee’s recommendations. Price-linked and stock compensation-type stock options for directors not serving on the Audit & Supervisory Committee (excluding outside directors) must be approved by the General Meeting of Shareholders, and the meeting agenda is determined by the Board based on the Nomination and Remuneration Advisory Committee’s recommendations.Matters Related to Non-monetary Incentives

To provide an incentive separate from the remuneration system, we have introduced paid performance target-linked subscription share options for our directors (excluding Audit & Supervisory Committee members) on the condition that they achieve a performance target, with the objective of inducing a medium-to-long-term increase in our shareholder value and corporate value. The number of these share options granted to each eligible person is determined in accordance with their position, given roles (mission grade), and other factors.Total amount of remuneration, etc. for each officer category, total amount of remuneration, etc. by type, and number of officers to whom it is applicable. (Results for FY2024)

| Officer category | Total amount of remuneration (Millions of yen) | Total amount of remuneration by type (Millions of yen) | Number of applicable officers (Number of persons) | ||

|---|---|---|---|---|---|

| Fixed remuneration | Performance-linked bonuses | Stock option | |||

| Director (excluding persons who are Outside Directors adn Audit & Supervisory Committee Members) | 450 | 205 | 26 | 219 | 5 |

| Outside Director (including Audit & Supervisory Committee Members) | 28 | 28 | – | – | 5 |

Policies and Procedures in Nominating Candidate Directors and Dismissing Directors

The Articles of Incorporation stipulate that directors (excluding Audit & Supervisory Committee members) and directors serving on the Audit & Supervisory Committee shall not exceed eight and five, respectively. We balance experience, knowledge, and skills, and value diversity when appointing them. We also require that attendance of at least 75% is ensured at the Board of Directors meeting when nominating candidates for directors.Policy for Nominating Candidates for Directors (Excluding Audit & Supervisory Committee Members)

Our policy for full-time directors is to appoint people with extensive knowledge and experience in the businesses and fields they are responsible for, who can be expected to drive the businesses and organizations they are responsible for and make appropriate decisions and supervise management appropriately. Our policy for outside directors is to appoint people who can be expected to make appropriate decisions, supervise management appropriately, and provide management advice from an objective and expert perspective, based on their experience as officers at other companies, their high level of expertise, and their deep insight.Policy for Nominating Candidates for Directors Serving on the Audit & Supervisory Committee

Our policy is to appoint personnel who can be expected to make appropriate decisions by using their high level of expertise and abundant experience in areas such as corporate management, finance, accounting, financing, corporate law, and compliance, and to audit and supervise the directors’ performance of duties and offer opinions on management in general.Process of Nominating and Dismissing Candidates for Directors

The Representative Director proposes candidates meeting these policies, and the Board nominates based on the Nomination and Remuneration Advisory Committee’s recommendations. When the Board makes these decisions, it obtains in advance the opinion of the Audit & Supervisory Committee regarding the candidate directors (excluding Audit & Supervisory Committee members) and the consent of the Audit & Supervisory Committee regarding candidates for directors serving on the Audit & Supervisory Committee. The Board monitors and supervises directors’ performance, and, after consulting with the Nomination and Remuneration Advisory Committee, deliberates on the dismissal of any director not meeting requirements.Skills Required of Director Candidates

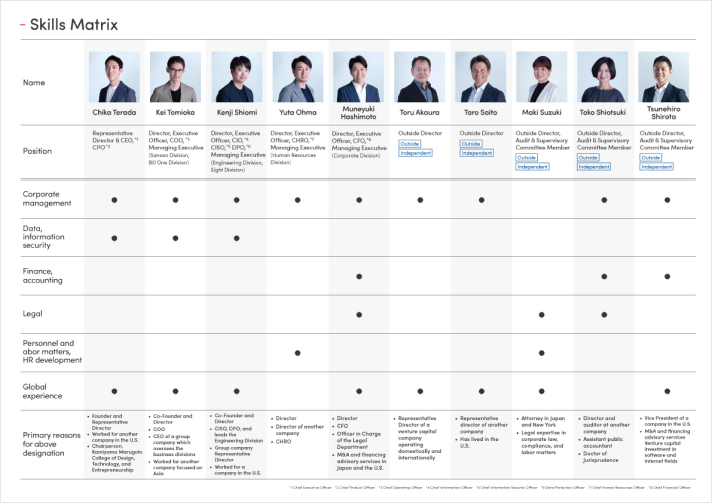

We have identified the following six skills the Board of Directors must possess to execute our management policies and management strategies, and we appoint directors with consideration for the diversity and balance of these skills.

| Skill | Reason for selecting skill | Definition |

|---|---|---|

| Corporate management | To reshape how companies and businesspeople facing various business issues work, develop solutions that drive digital transformation, achieve sustainable growth for our company, and resolve social issues in the context of major changes in the business environment, we need directors with experience in corporate management and experience managing organizations, such as business divisions and headquarters, as senior executives. | Experience as a director or as a senior executive in organizational management |

| Data, information security | To develop and provide highly convenient, safe, and stable services and leverage our strengths in digitization to develop and provide innovative AI transformation solutions, we need directors with business experience in the data domain and abundant knowledge and experience in information security. | Experience in business, technology development, and research and development in the IT and SaaS industries, and experience in information security-related operations and management |

| Finance, accounting | To ensure appropriate financial reporting, build a financial foundation, and make growth investments such as new businesses, research and development, M&A, etc., we need directors with business experience in financing and knowledge and experience in finance and accounting. | Knowledge, operational experience, and management experience in finance, financing, and accounting in corporate management |

| Legal | To fortify our management foundation to support our business growth by strengthening corporate governance and thoroughly implementing compliance, we need directors with knowledge and experience in the corporate governance, legal, and compliance areas. | Knowledge, operational experience, and management experience in corporate governance, legal affairs, and compliance |

| Personnel and labor matters, HR development | To promote the recruitment, development, and success of human resources, as well as diversity, equity, and inclusion, and to create and provide opportunities and environments for our diverse workforce to enjoy success, we need directors with business experience in HR development and abundant knowledge and experience in personnel and labor matters. | Knowledge, operational experience, and management experience in staff development, organization development, and personnel and labor matters |

| Global experience | To promote the overseas business of AI transformation solutions and conduct important decision-making and supervision for their management, including strengthening development capabilities and technical capabilities, etc., we need directors with global business experience and abundant knowledge and experience in the overseas business environment. | Experience of being posted, stationed, or residing overseas, and business experience in overseas business, overseas investment, etc. |

Other Initiatives

Support Structure for Directors

We provide documents, explanations, etc., in advance to support Board deliberations and directors’ management supervision and auditing functions. The full-time members of a secretariat help the Audit & Supervisory Committee, comprising outside directors, function smoothly. With access to key meetings and documents, the secretariat members can promptly provide materials the Committee needs. It also arranges expenses-paid, third-party training for directors.Group Governance

We have developed a group policy, etc. commonly applied to the subsidiaries, and under the Rules on Management of Subsidiaries, our basic policy concerning the involvement in management of our subsidiaries, we strive for a system that strengthens governance, including management agreements with subsidiaries pursuant to these Rules. The Internal Auditing Department regularly audits subsidiaries to ensure compliance with laws, the Articles of Incorporation, and internal regulations.Cross-Shareholdings

Regarding the classification of investment shares held for pure investment purposes and investment shares held for other than pure investment purposes, we judge that investment shares held exclusively for the purpose of receiving profits from fluctuations in share values or dividends on shares are investment shares for pure investment purposes and other investment shares are investment shares for other than pure investment purposes. When considering the acquisition of investment shares held for other than pure investment purposes, the Board of Directors verifies the reasonableness and advisability of holding the shares, considering such matters as whether holding the shares will lead to a medium-to-long-term increase in our corporate value owing to business synergies or other factors, whether it will negatively impact our financial soundness, and whether the holding ratio and acquisition amount exceed the reasonably necessary range. From a corporate governance perspective, we will not hold cross-shareholdings for the sole purpose of securing stable shareholders. If we intend to hold cross-shareholdings, the Board will scrutinize the reasonableness and appropriateness of the holding before it is implemented.Special Resolution Requirements of the Shareholders’ Meeting

Resolutions of the shareholders’ meeting concerning important matters of corporate management, including amendments to the Articles of Incorporation, require a special resolution pursuant to Article 309, Paragraph 2 of the Companies Act. The Articles of Incorporation stipulate that, with respect to the special resolution requirements of the shareholders’ meeting under Article 309, Paragraph 2 of the Companies Act, such a resolution shall be adopted with the attendance of shareholders holding no less than one-third of exercisable voting rights, and the approval of at least two-thirds of those voting rights. This aims to facilitate the smooth operation of shareholders’ meetings by relaxing the quorum requirements for special resolutions at such meetings.Details etc. of Remuneration for Audits

(Millions of yen)

| Category | FY2023 | FY2024 | ||

|---|---|---|---|---|

| Remuneration based on audit and attestation services | Remuneration based on services other than auditing | Remuneration based on audit and attestation services | Remuneration based on services other than auditing | |

| Reporting company | 37 | – | 38 | – |

| Consolidated subsidiaries | – | – | – | – |

| Total | 37 | – | 38 | – |

Directors

Chika Terada Representative Director & CEO, CPO December 29, 1976

Chika began his career with MITSUI & CO., LTD. During that time, he relocated to Silicon Valley to help local venture firms develop their Japan-focused efforts. In 2007, he founded Sansan, Inc., providing AI transformation solutions that change how people work, including the namesake Sansan business database.

Reasons for nomination

Because Chika Terada has served as the Company’s Representative Director consistently since its establishment and has many years of management experience. He also has demonstrated strong leadership as CEO in planning strategies and executing operations in all aspects of the Company’s business, and has achieved timely and appropriate decision-making and management supervision.

Kei Tomioka Director, Executive Officer, COO May 26, 1976

Kei began his career with Oracle Corporation Japan, and was based in Shanghai and Bangkok, taking charge of market development across Greater China (China, Hong Kong, Taiwan), Southeast Asia, and India. In 2007, Kei co-founded Sansan, Inc. and has led business efforts for Sansan, the business database. As COO, he oversees Sansan and other B2B SaaS businesses. From 2023, he has served as CEO of Sansan Global Pte. Ltd.

Reasons for nomination

Because Kei Tomioka co-founded the Company, and has contributed to the Company’s business esaxpansion and sales maximization by utilizing his knowledge in the sales department by driving the growth of the Sansan/Bill One business, which is the Company’s main business, as COO and Executive in charge, and also by promoting the Company’s domestic and overseas business development.

Kenji Shiomi Director, Executive Officer, CISO, DPO, Engineering Division Head August 12, 1970

Kenji co-founded Sansan, Inc. in 2007, after working with Bussan System Integration Co., Ltd. (now Mitsui Knowledge Industry Co., Ltd.), where he designed and developed mail systems for major mobile carriers. Since 2012, he has been in charge of the Eight: Business card app. Now as Engineering Division Head, he oversees the company-wide technology strategy and strengthens its engineering group. In 2023, he also assumed the role of President of Sansan Global Development Center, Inc.

Reasons for nomination

Because Kenji Shiomi co-founded the Company and has promoted service expansion and monetization as Executive in charge of the Eight Business. Furthermore, as CISO and Executive in charge of the Engineering Division, he has led the development department and information security department, contributing to business expansion and sales maximization by strengthening the Company’s products.

Yuta Ohma Director, Executive Officer, CHRO September 27, 1983

Yuta began his career at a human resources company, where he helped launch a consulting service. He then went independent and served as a director for a venture firm in recruitment. Yuta joined Sansan, Inc. in 2010 as a Manager in sales and later became the head of HR. As Chief Human Resources Officer (CHRO), he leads strategies for optimizing the value and productivity of Sansan’s workforce.

Reasons for nomination

Because Yuta Ohma is at the present time CHRO and Executive in charge of Human Resources Division and is responsible for planning and executing practical human resources development and recruiting strategies. He is promoting to put in place personnel policies and systems that involve a high level of difficulty in an expanding and diversifying organization. He has thus contributed to the expansion of human capital, which is essential for the Company’s business growth, and business expansion.

Muneyuki Hashimoto Director, Executive Officer, CFO January 10, 1982

Muneyuki worked for foreign securities companies in Tokyo and New York for nearly 9 years, providing M&A and financing advisory services. He then moved to a group company of the Development Bank of Japan to work in private equity. He joined Sansan, Inc. in 2017, and was appointed CFO in 2018 to lead the company’s financial strategy.

Reasons for nomination

Because Muneyuki Hashimoto has contributed to the achievement of the business plan through directing the Company’s financial strategy and managing its business performance as CFO and Executive in charge of Corporate Division. He has also contributed to the Company’s business expansion and enhancement of the corporate governance through his supervision and management of investment strategies and the Corporate Department.

Tohru Akaura Outside Director August 7, 1968

Tohru is a General Partner at Incubate Fund. Following his involvement in investment development tasks at Japan Associated Finance Co., Ltd. (now JAFCO Group Co., Ltd.), he founded his own venture capital company. Having become an Outside Director of Sansan, Inc. in August 2007, he makes general management recommendations.

Reasons for nomination

Because Tohru Akaura has long-term work experience in the venture capital business and extensive experience and a wide range of insight as an officer in other companies, so the Company anticipates that he will provide appropriate decision-making and management supervision and managerial advice on general management and corporate investment from an objective and professional perspective.

Shigemiki Komori Outside Director April 7, 1958

Shigemiki held key positions mainly in the corporate sales division at Hewlett-Packard Japan, Ltd., before being appointed Representative Director, Executive Vice President in 2014. From 2015, he served as Vice President of Salesforce Japan Co., Ltd., leading its Enterprise Business Division. After serving as Vice Chairman of the Board in 2024, he stepped down in February 2025. He was appointed as an Outside Director of Sansan, Inc. in August 2025. Shigemiki draws on his extensive management experience and broad insight to provide recommendations on sales strategy and organizational management.

Reasons for nomination

Because Shigamiki has held key executive positions, including representative director, at the Japanese subsidiaries of multiple global IT companies, and possesses extensive experience in sales strategy, organizational management, and the promotion of sales DX in the enterprise business and the software business, the Company anticipates that he will provide appropriate decision-making and management supervision, as well as valuable advice on sales strategy and organizational operation, from an objective and professional perspective.

Maki Suzuki Outside Director, Audit & Supervisory Committee Member July 4, 1977

Maki, an attorney at law, was admitted to the New York State Bar Association after working since 2003 at TMI Associates. She joined the Shintaro Sato Law Office in 2017 and has been a member of the Dai-Ni Tokyo Bar Association since 2021. She became an Outside Director of Sansan, Inc. in August 2022. Her expertise is in corporate legal affairs and compliance, and she provides recommendations from a legal and diversity perspective.

Reasons for nomination

Because Maki Suzuki has experience as an officer at other companies and has gained specialist knowledge in corporate legal affairs and compliance, etc., as well as a wealth of insight in judicial precedents, in her career as an attorney, so the Company expects that she will provide important opinions on the Company’s management from a legal perspective as well as on diversity and auditing and supervising the Directors’ performance of their duties.

Toko Shiotsuki Outside Director, Audit & Supervisory Committee Member January 9, 1973

Toko is a Director at CyberAgent, Inc., a Junior Accountant, and a Juris Doctor. After working with Japan Airlines Co. Ltd., she joined CyberAgent as a Standing Auditor, and in 2017 became a Director. Toko became an Outside Director of Sansan, Inc. in August 2021. She gives guidance on auditing and diversity, applying accounting and legal knowledge along with corporate experience.

Reasons for nomination

Because Toko Shiotsuki has degrees as a junior accountant and a doctor of jurisprudence (professional) and has extensive experience in other companies leveraging her broad insight in accounting, auditing and legal affairs, so the Company expects that she will provide important opinions on the Company’s management from a legal perspective as well as on diversity and auditing and supervising the Directors’ performance of their duties.

Tsunehiro Shirota Outside Director, Audit & Supervisory Committee Member September 22, 1982

Tsunehiro worked at Lehman Brothers Japan Inc. and Barclays Capital Securities Japan, Ltd. before joining Evernote Corporation, where he served as Vice President in several parts of the company. He then became a partner at WiL, LLC (World Innovation Lab). He was appointed as an Outside Director of Sansan, Inc. in August 2024. Tsunehiro uses his extensive experience to provide recommendations from an investment, financial, and corporate governance perspective.

Reasons for nomination

Because Tsunehiro Shirota has extensive experience and broad insight, having been involved in domestic and cross-border M&A deals, fundraising, and startup investments, as well as a considerable amount of knowledge related to finance and accounting, so the Company expects that he will provide important opinions, including perspectives of investment, finance, and corporate governance, on the Company’s management as well as audits and supervises the Directors’ performance of their duties.

| Name | Date of appointment as director | Number of shares held*2 | Attendance at Board of Directors meetings*3 | Committee membership | Priority areas related to sustainability under the control of this director |

|---|---|---|---|---|---|

| Chika Teraada | June 2007 | 8,185,300 | 13 of 13 times | Executive Committee | Conserving the Environment Through Business |

| Kei Tomioka | June 2007 | 4,119,400 | 13 of 13 times | Executive Committee | Transforming Work Through Innovative Digital Transformation Services |

| Kenji Shiomi | June 2007 | 2,209,400 | 13 of 13 times | Executive Committee | Balancing Security and Convenience |

| Yuta Ohma | August 2019 | 144,912 | 13 of 13 times | Executive Committee | Respecting Employee Diversity and Producing Innovation |

| Muneyuki Hashimoto | August 2020 | 163,292 | 13 of 13 times | Executive Committee | Establishing a Firm Management Structure to Support Rapid Business Growth |

| Tohru Akaura | August 2007 | 1,720,000 | 12 of 13 times | Nomination and Remuneration Advisory Committee | – |

| Shigemiki Komori | August 2025 | 0 | – | Nomination and Remuneration Advisory Committee | – |

| Maki Suzuki | August 2022 | 0 | 13 of 13 times | Audit & Supervisory Committee Nomination and Remuneration Advisory Committee | – |

| Toko Shiotsuki | August 2021 | 0 | 13 of 13 times | Audit & Supervisory Committee | – |

| Tsunehiro Shirota | August 2024 | 0 | 10 of 10 times*4 | Audit & Supervisory Committee | – |

- *2 As of the end of May 2025

- *3 FY2024 Results

- *4 For Tsunehiro Shirota, attendance has been stated for the period since his appointment on August 27, 2024.